The Tennessee Legislature has taken the first step toward imposing a 10% tax on certain vapor products, such as vape pens, vape molds, cig-a-likes, and pod mods, and requiring FDA approval before vape products can be sold in the state. The Republican-led measure, Senate Bill 763, was approved by the Senate Commerce and Labor Committee in a 7-1 vote, despite strong opposition from the vape industry.

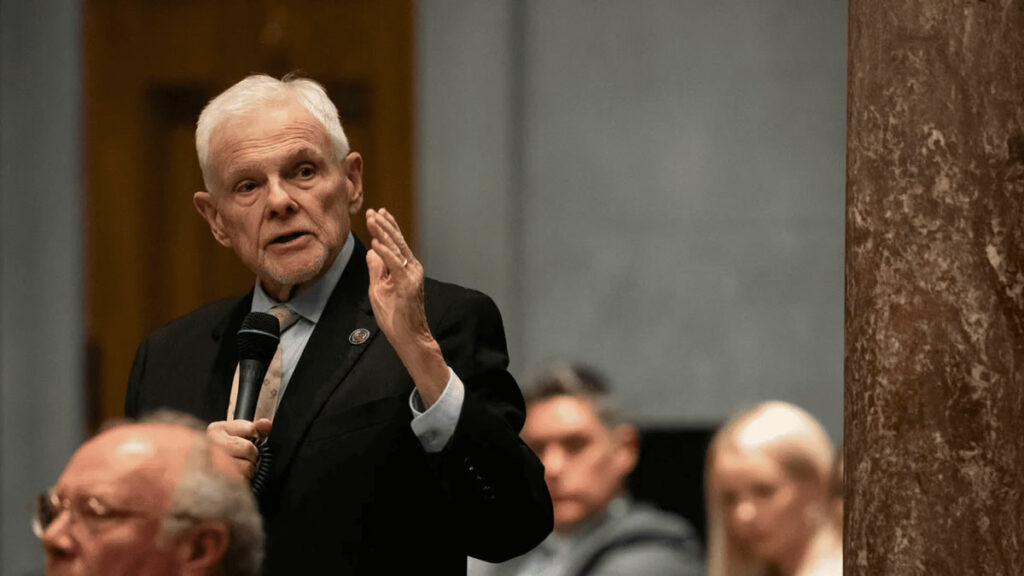

Sponsored by Sen. Ken Yager (R-Kingston) and Senate Finance Chairman Bo Watson (R-Hixson), the bill aims to address the influx of illegal Chinese vape products that are allegedly addicting and harming children. “It is not an attack on legitimate businesses. It is an attack on people who are selling their soul and poisoning children to make a buck,” Yager said during the hearing.

New Requirements and Projected Revenue

In addition to the 10% tax on vapor products, Senate Bill 763 would require vapor product manufacturers to register with the state and pay an annual $25 fee to ensure only FDA-approved products are sold. The bill also mandates that customers show proof of age when buying tobacco, vape, hemp, and smokeless nicotine products.

The new tax is projected to generate nearly $16.5 million in new revenue for the state, according to a fiscal analysis. Currently, Tennessee levies a $0.62 per pack excise tax on cigarettes and a 6.6% tax on other tobacco products, while smokeless nicotine products remain untaxed.

Opposition from Vape Industry

Danny Gillis, president of the Tennessee Smoke Free Association and owner of three vape shops, called the bill an effort to “allow big tobacco to take over our harm reduction industry.” He warned that the bill would remove 99% of vape products from the market, create an unfair tax structure, and potentially lead to the closure of as many as 700 vape businesses across the state.

“This is the latest example of a continued weaponization of public health rhetoric to justify the prohibition of vaping products under the guise of protecting youth,” Gillis said. “There is no public health justification for removing safer alternatives to cigarettes while allowing combustible tobacco cigarettes to remain widely available.”

Balancing Public Health and Industry Concerns

As the bill moves forward in the Tennessee Legislature, lawmakers will need to balance the competing interests of protecting public health, particularly youth, from the potential harms of vaping, while also considering the economic impact on the vape industry and the availability of alternative nicotine products for adult consumers.

The outcome of this legislative effort could have significant implications for the regulation and taxation of vape products in Tennessee and may serve as a model for other states considering similar measures to address the growing concerns surrounding vaping and its impact on public health.

- UK Announces Mandatory Vape Tax and Duty Stamps from 2027 - February 10, 2026

- Sri Lanka Travel 2026: Total Ban on Cigarettes & Vapes - February 5, 2026

- NY Tax Proposal: Hochul Targets ZYN with 75% Levy - January 29, 2026